- Ondo finance’s latest partnership aims to enhance Stellar’s existing $250 million stablecoin market by embedding real-world assets into payment flows.

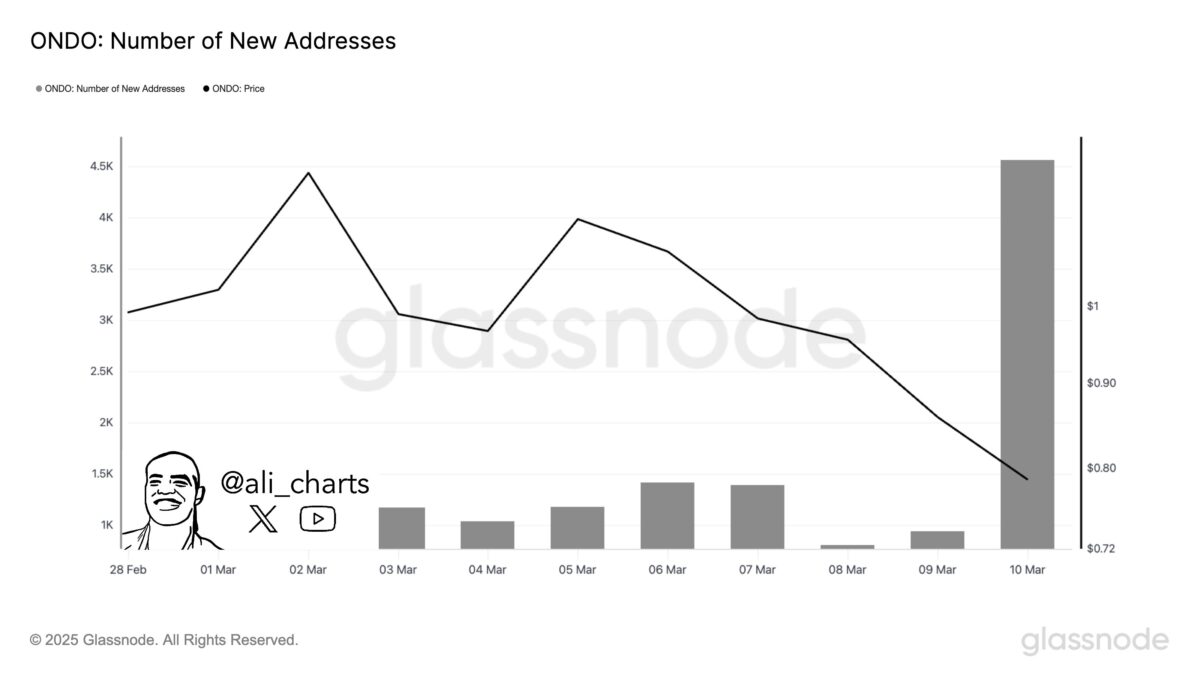

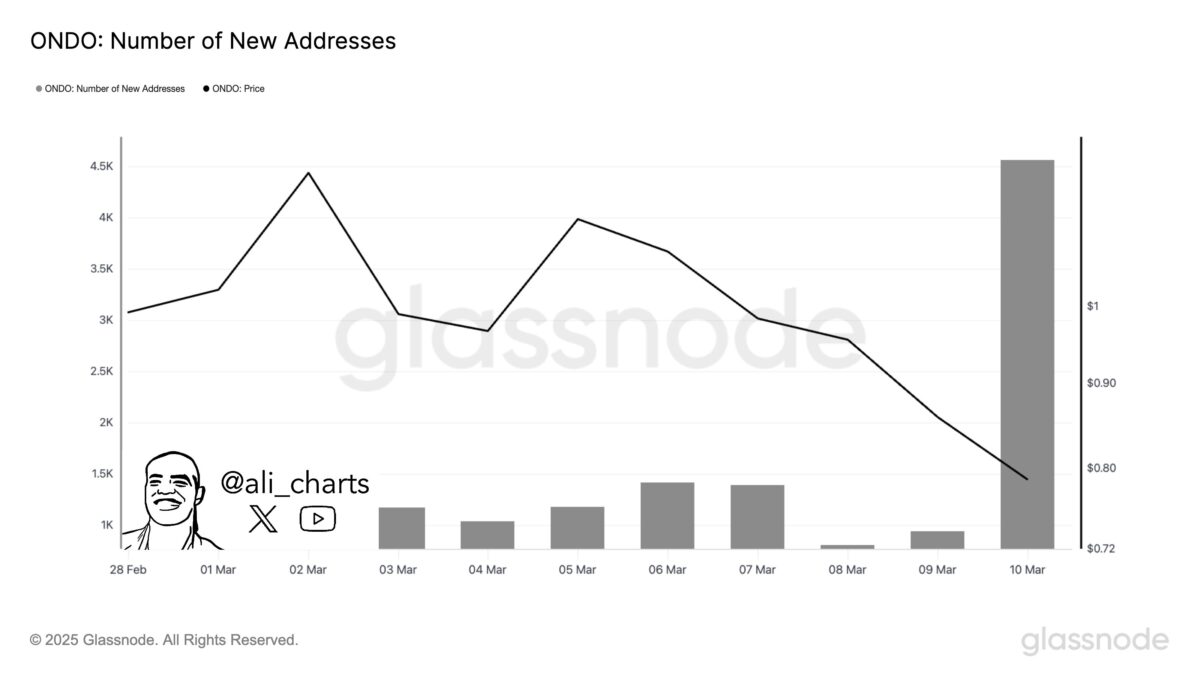

- The ONDO token has seen renewed investor interest, with a 390% spike in new wallet addresses in just 24 hours, rising from 935 to 4,559.

In the latest development, Ondo Finance announced the expansion of its tokenized US securities to the leading blockchain payments ecosystem, the Stellar Network. This integration seeks to bring yield-bearing real-world assets to Stellar’s robust payment infrastructure, which is already serving the Global South and unbanked populations worldwide.

Ondo Finance Expands Tokenized Treasuries to Stellar Network

Ondo Finance has recently chosen to partner with the Stellar Network for the expansion of its tokenized US Treasuries. As a result ot this collaboration, Stellar’s robust payment infrastructure will get yield-bearing real-world assets.

The Stellar blockchain has more than 425,000 stablecoin users and $32 billion in payment volume recorded in 2024. It has also emerged as one of the key players in global payments, cross-border remittances, and payroll services. Furthermore, its association with big players like MoneyGram, Lobstr, and Decaf, has strengthened Stellar’s role in enabling small businesses and unbanked communities to access financial tools and resources.

Ondo stated that the existing $250 million stablecoin market on the Stellar blockchain supports payments, treasury management, and corporate payouts. However, Ondo’s integration of yield-bearing tokenized treasuries could significantly enhance this ecosystem.

By embedding real-world assets into payment flows, Stellar network could generate an estimated $10 million in annual yield. This will provide small businesses and local economies new opportunities for growth. As part of its 2025 roadmap, Stellar is also willing to make further inroads into the world of decentralized finance (DeFi). As highlighted in our last news piece, Stellar is eyeing to attain a total value locked (TVL) of $1.5 billion.

With this development, Stellar aims to become a central hub for monetizing cash balances, hedging against inflation, and enabling on-chain savings, positioning itself as a leader in blockchain-driven financial innovation.

Ondo Price Eyes A Move Above $1 Amid Surging Address Activity

The Ondo price trajectory has reversed to the upside after facing a strong sell-off earlier this week. As of press time, the ONDO price is trading 7.75% up at $0.88, with its market cap soaring past $2.75 billion. Furthermore, as per the Coinglas data, the Ondo futures open interest is also up 7% to $194 million, suggesting strong investor interest.

Crypto analyst, Ali Martinez, has reported a significant spike in the creation of new ONDO addresses, with a 390% increase recorded within a single day. The number of addresses surged from 935 to 4,559 in the past 24 hours, signaling heightened interest and activity surrounding the ONDO token.

Ondo finance has been gaining the limelight over the past month as Donald Trump’s DeFi project World Liberty Financial has included ONDO as part of its reserves. Moreover, it has achieved significant milestones.

As reported by CNF yesterday, the total-value-locked (TVL) on Ondo Finance has surged to $1 billion for the first time, a sharp rise from $541 million at the beginning of the year. As a result, market analysts are confident of an 110% rally for the altcoin.

Leave a Reply